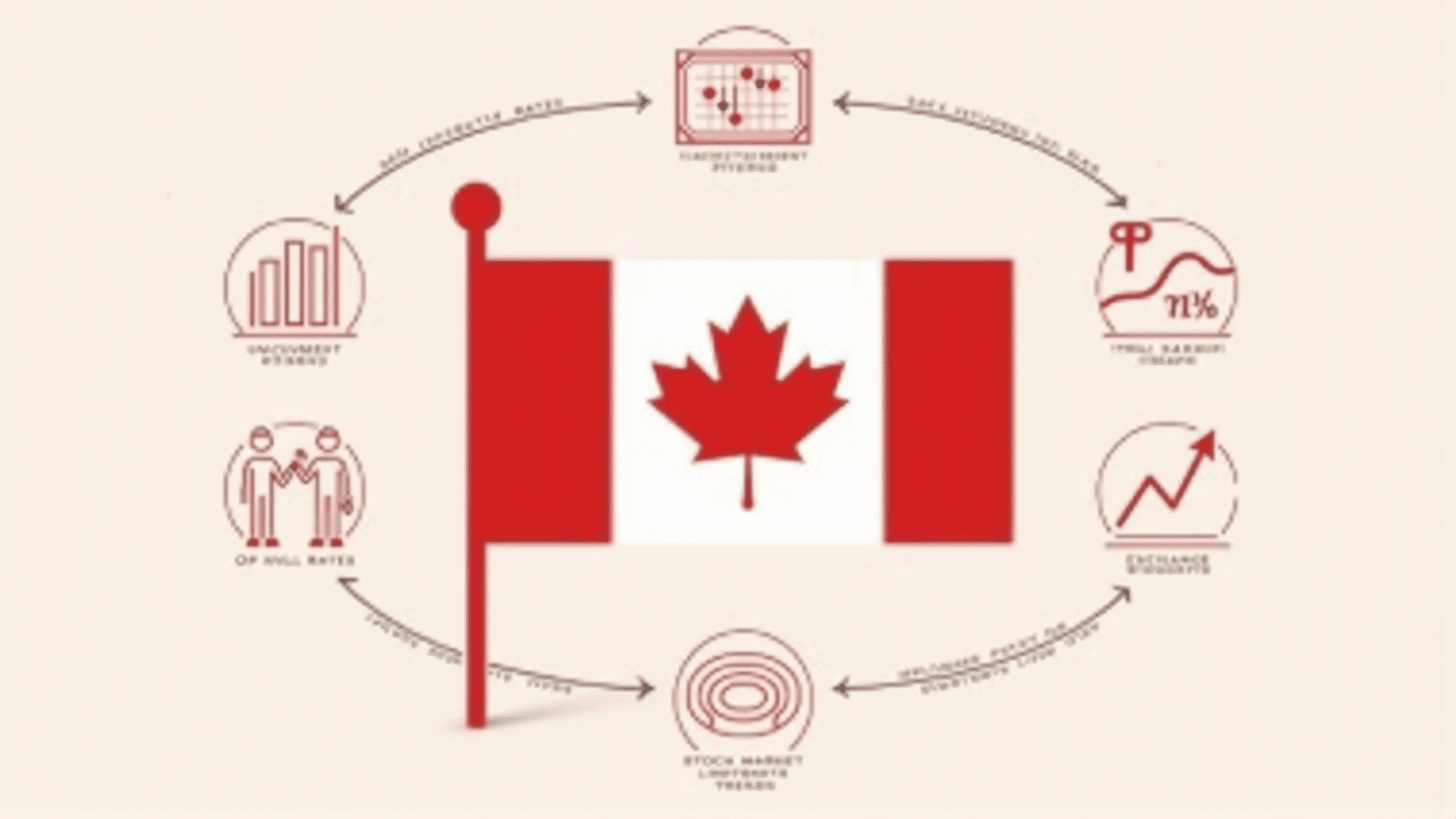

Understanding the stability and growth of a country's economy requires examining various indicators that provide insights into its overall health. In Canada, these indicators play an integral role in shaping decisions and predicting future trends. Here are some of the key indicators used to assess Canada's economic landscape.

Gross Domestic Product (GDP): GDP is a crucial indicator that measures the total value of goods and services produced within the country over a specific period. It reflects the size and performance of Canada's economy. A rising GDP typically indicates robust economic growth, while a declining GDP might signal an economic slowdown.

Unemployment Rate: This indicator reflects the percentage of the workforce that is unemployed and actively seeking employment. It provides insights into the job market's health and can influence economic policies. A low unemployment rate generally indicates a strong job market and potentially increasing consumer spending.

Inflation Rate: Inflation measures the rate at which the general level of prices for goods and services is rising, eroding purchasing power. Canada's central bank closely monitors inflation to maintain it at an optimal level, which is essential to ensure that the economy grows at a sustainable pace.

Trade Balance: This reflects the difference between a country's exports and imports. A positive trade balance, where exports exceed imports, is typically favorable as it suggests that Canada is successfully producing goods and services valued by other countries. Conversely, a negative balance might indicate increased foreign dependency.

Consumer Confidence Index: This measures how optimistic or pessimistic consumers are regarding their expected financial situation and the overall economic environment. High consumer confidence usually encourages spending and can signal economic expansion, while low confidence might lead to decreased spending and economic contraction.

Manufacturing Output: As part of Canada's economic makeup, manufacturing is a vital component. Changes in manufacturing output can indicate shifts in demand for Canadian products both domestically and internationally, affecting employment and growth rates in related sectors.

Housing Market Statistics: The housing market is a significant component of the Canadian economy. Metrics such as housing starts, home sales, and prices provide insights into economic conditions. A buoyant housing market can stimulate activity in other industries, such as construction and retail.

Retail Sales Data: This represents the total receipts of retail stores and is a primary measure of consumer demand for finished goods. As consumer spending accounts for a large portion of economic activity, retail sales data is closely watched to understand spending patterns and infer economic health.

Interest Rates: Set by the central bank, interest rates influence borrowing costs for consumers and businesses. Lower rates typically encourage borrowing and spending, stimulating economic growth, whereas higher rates may slow down borrowing and spending, keeping inflation in check.

In conclusion, these indicators collectively paint a comprehensive picture of Canada's economic landscape. Observing and analyzing these metrics helps policymakers, businesses, and individuals make informed decisions and adapt strategies to ensure continued economic resilience and growth.